What is Diminished Value?

Diminished Value is defined as the loss of value a vehicle suffers related to an auto accident or unexpected damage.

There are 4 types of diminished value:

1. Immediate Diminished Value is defined as the immediate loss of resale value a vehicle suffers at the time of damage, before repairs have been made. This is based on the difference between the Pre-loss Value and the value of the vehicle immediately after a collision.

2. Insurance Related Diminished Value is defined as the loss of value a vehicle incurs due to failure of an insurance company to properly assess and repair a vehicle.

3. Repair Related Diminished Value is defined as the loss of value a vehicle suffers due to improper repairs made by an auto body shop during the repair process.

4. Inherent Diminished Value is the difference in value a vehicle suffers between pre-loss and post-repaired condition after collision damage. This is determined by applying a hypothetical assumption that the vehicle has been completely repaired to perfect pre-loss condition, immediately after the loss. In inherent diminished value, the loss of value is based on the stigma the vehicle now has due to a prior accident history. The year, type, style and severity of damage can play an important part in determining inherent diminution of value.

Do I Have Diminished Value?

If your vehicle was in an accident that caused damage to your vehicle, in most situations you have suffered some type of diminished value. But, that doesn’t mean you have a claim that either can be pursued, or is worth pursuing. First, we must determine several qualifiers to dermine if you have good claim.

- Is your vehicle more than 10 years old?

- Is your vehicle in less than average condition?

- Is the average Trade-In value of your vehicle less than $8,000? You can determine your vehicle’s value using NADA

- Your vehicle has been in a previous accident where the cost of repairs were more than $500 and/or damage was to 2 or more body panels?

- Has your vehicle previously suffered frame or structural damage/labor?

- Have you signed a release of liability form?

- Have the statute of limitations lapsed in the state the accident occured?

- Has your car or truck previously been declared a total loss?

- Has your car or truck previously been branded a flood vehicle?

- Has your car or truck previously been branded a stolen vehicle?

- Has your car or truck previously had any type of brand on the title?

- Your vehicle has excessive mileage? Normally more than 25k per year or over 100,000 miles?

- Were you determined to be at fault and the the accident did not occur in Georgia?

If you answered NO to all of these questions, you have a good chance of recovering diminished value?

Can I collect Diminished Value?

If you are not at-fault, you are allowed to pursue diminished value in every state in the United States. There are some states that have different laws pertaining to diminished value. Michigan is a no-fault state and you must file a lawsuit against the at-fault driver instead of filing a claim against their insurance company. Here are a few other unique situations:

- You were at-fault. If the accident happened in Georgia, Kansas or Washington, you may be able to file a claim against your own insurance company. Policy restrictions may apply.

- Uninsured Motorist – In Alaska, Arkansas, California, Delaware, District of Columbia, Georgia, Hawaii, Illinois, Indiana, Louisiana, Maryland, Mississippi, New Jersey, New Mexico, North Carolina, Ohio, Oregon, Rhode Island, South Carolina, Tennessee, Texas, Utah, Vermont, Virginia, Washington and West Virginia, you may be allowed to file a claim against your own insurance company if the at-fault driver was uninsured. You must have Uninsured Property Damage Insurance, and there may still be policy restrictions.

- Under-insured Motorist. Again, in Alaska, Arkansas, California, Delaware, District of Columbia, Georgia, Hawaii, Illinois, Indiana, Louisiana, Maryland, Mississippi, New Jersey, New Mexico, North Carolina, Ohio, Oregon, Rhode Island, South Carolina, Tennessee, Texas, Utah, Vermont, Virginia, Washington and West Virginia, you may be allowed to file a claim against your own insurance company if the at-fault driver was under-insured. You must have Under-insured Property Damage Insurance, and there may still be policy restrictions.

- Victim of Hit And Run. If the driver is unknown, or uninsured, you may still be able to file a claim for diminished value. See Uninsured Motorist above.

Does every vehicle accident qualify for a diminished value claim?

No, You need to determine if your vehicle will qualify.

- Is your vehicle more than 10 years old?

- Is your vehicle in less than average condition?

- Is the average Trade-In value of your vehicle less than $8,000? You can determine your vehicle’s value using NADA

- Your vehicle has been in a previous accident where the cost of repairs were more than $500 and/or damage was to 2 or more body panels?

- Has your vehicle previously suffered frame or structural damage/labor?

- Have you signed a release of liability form?

- Have the statute of limitations lapsed in the state the accident occured?

- Has your car or truck previously been declared a total loss?

- Has your car or truck previously been branded a flood vehicle?

- Has your car or truck previously been branded a stolen vehicle?

- Has your car or truck previously had any type of brand on the title?

- Your vehicle has excessive mileage? Normally more than 25k per year or over 100,000 miles?

- Were you determined to be at fault and the the accident did not occur in Georgia?

If you answered yes to any of these questions, you probably do not have a claim.

How do you calculate diminished value of a vehicle?

We follow USPAP (Uniform Standards of Appraisal Practice) when producing an appraisal. Determining diminished value is very complex, but here’s a basic outline on how we calculate the value.

- We start with determining the seller’s market. If you’re an auto dealer, the largest market would be the Retail market to sell the vehicle in. If you’re a private owner, the largest market than a vehicle less than 10 years old is sale to a auto dealer. The insurance companies prefer to use Retail and Private Party Markets as it is easier to disprove diminshed value. Not all dealer react the same. Which is why we survey more than just New Car Dealers. New Car Dealers may pay the least amount for your vehicle, because they can carry the heaviest burden. If they sell a frame or structural damaged repaired vehicle, they may be liable if someone is killed in the vehicle, so they may send the vehicle to auction and pay the least. Whereas a used car dealer may pay more. He has limited assets and may be willing to try to sell the vehicle for close to full retail. We survey all types of dealers to determine an average that a dealer may purchase your vehicle for. This follows USPAP for using the largest market similar sellers would use and stands up well in court.

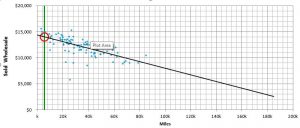

- We used sold wholesale vehicles to compare against book values to produce a credible pre-loss value a dealer would purchase the vehicle with no prior damage.

- We then use an algorithm based on surveyed auto dealership appraisers to detemine the average amount the surveyed dealers would reduce their offer to purchase based on the vehicle having a specific type of damage and/or repairs.

- The Government Certified and Licensed Auto Appraiser makes an additional adjustment based on specific market conditions at the time of loss. This allows for a mathimatical solution, but with the added benefit of an adjustment by an appraiser with knowledge of the vehicle sales market.

How do Auto Dealers Calculate Diminished Value?

Auto Dealers may use different formulas or ideology in detemining the amount they may offer for a vehicle with a prior damage history. We surveyed over 100 new car desk managers over the past 5 years and found that desk managers may offer much less than an actual used car manager may. Normally this is because the Desk Manager may not have current knowledge of the used car market, where a used car manager will normally be purchasing and selling vehicles daily thru auctions and wholesalers.

For a vehicle with prior frame damage, this is normally the formula a new car dealership’s desk manage will use to determine the ACV (Actual Cash Value) of a vehicle they are taking in on trade-in or purchasing from an individual.

Typically a new car desk manager is told to reduce the whosale value by 35-50%.

Then subtract the cost to recondition the vehicle – Tires, dents, dings, cleaning, etc.

Then subtract the cost of incidentials – Auction fees, transpotation, slush fund for repairs, etc.

Then because they are a business, to build in some reasonable type of profit, normally $500-$1,000.

A vehicle with a wholesale book of $20,000 could easily be worth as little as $7-8,000 to a new car dealer.

How do insurance companies calculate diminished value?

Insurance companies normally want to pay out as little as possible. One such way that State Farm developed was the Formula 17c. This formula is based on a calculated value and doesn’t really make any logical sense. Calculated value means that no actual market comparables were used, and that it does not allow for color, condition and many other variances a vehicle could have that could cause it to be worth more or less.

The biggest error in this formula, is that there is a cap of 10% of the total value of the vehicle. There is no explaination how this 10% car was determined, although it’s pretty obvious that it would save State Farm millions of dollars per year since most DV claims are over 20% of the vehicle’s value.

What is the diminished value of my car?

We have a Free Diminished Value Claim Calculator for estimating your diminished value. This should only be used for estimation as there are so many things that could affect your loss of value that it is impossible to produce a simplistic algorithm that is not taking into account actual sold vehicles, when we do in the determination of your diminished value. We used sold comparable vehicles and build a trendline to determine an average value.

What States have diminished value?

You may file a claim for diminished value in all 50 states, plus District of Columbia (which is not a state). Even Canada pays diminished value claims. Michigan is a no fault state and it may be harder than normal to recover your loss in this state.

How much does a diminished value appraisal cost?

When a person asks me about an appraisal and compares it to a lot of other assessments, I have to laugh. I see “reports” and “assessments” all the time that mean nothing. They follow no appraisal standards, and most are arbitrary values at best. I’ve even seen diminished value appraisals that had little to no logic or value. It’s not just whether it is a report, assessment or appraisal, it depends on who produces it.

The cost of a diminished value appraisal can range from about $35.00 thru VVS, which is the go to appraisal service for several insurance companies, to $1,500 or more if you go thru a diminished value lawyer.

Would you want the estimator who wrote the estimate to fix your car to produce an appraisal for your home? Well, it’s sort of the same thing here. Very seldom do I come across an auto appraiser who actually has a background in vehicle valuation, and not auto damage repair. Who would you rather produce an appraisal for you to determine the overall value of your vehicle?

An Appraiser with over 20 years experiece employed by automotive dealers to market, inspect and appraise vehicles they are purchasing and selling.

OR

An Appraiser with over 20 years experience, who’s written over 30,000 estimates at their auto body shop for auto damage repair.

OR

An Appraiser with over 25 year experience as a State Farm Agent.

We have worked to make our appraisals as affordable as possible. You can check our current pricing here.